Advertisement

Table Of Contents

Key points

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from […]

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

Well when it rains in the discount brokerage world, it certainly pours. Fitting for November. This week’s roundup looks back on a busy week filled with a major discount brokerage ranking being released, a very cool (and geeky) way to learn about options pricing as well as a frenzy of conversation about discount brokerages from the forums. It’s a full card so this roundup is 2 pages long – be sure to check out the ending for some sage ‘market wisdom’ courtesy of Guns N’ Roses.

2013 Online Brokerage Rankings are here

After a lot anticipation, the 2013 Online Broker Rankings were finally released this past week by the Globe and Mail’s Rob Carrick. This year the online broker rankings went back to the ‘report card’ style evaluation of 12 Canadian discount brokerages, with each broker receiving letter grades rather than percentages. In line with the past few evaluations (learn more about the historical online brokerage rankings here) the key criteria being measured were:

- Costs

- Account Info

- Trading

- Tools

- Innovation

While getting called a cheap option by one of Canada’s largest newspapers may not seem flattering, for a discount brokerage in the midst of a price war the label is a badge of honour. The brokerage with the best overall ranking (and ‘cheapest broker’) for 2013 was Virtual Brokers (overall grade: A) for the second year in a row. The first runner up was Qtrade (overall grade: B+).

Despite being tied for third with RBC Direct Investing and Scotia iTrade, BMO InvestorLine was described as “the best bank-owned” online brokerage (each of these bank-owned online brokerages scored a B overall). The media team at BMO published a release celebrating the claim. Incidentally, Questrade also received an overall grade of “B”. The worst overall score received this year was a “D” and it was given to HSBC InvestDirect along with some pointed remarks about their offering.

Some new features in this year’s online broker rankings included comparisons of current margin rates, forex rates and costs for trading certain amounts of stock at each broker. To read the online brokerage rankings, click here. Also, stay tuned for the in-depth analysis of this year’s Globe and Mail online broker rankings coming soon.

Probably worth a look

Interactive Brokers recently released a new tutorial and tool geared towards trading options based on probabilities. Interactive Brokers’ new tool is called the “Probability Lab” and is available on the Trader Workstation platform.

In a nutshell, the tutorial attempts to explain the process of forecasting future stock prices without using a lot of mathematical language. While it does provide an overview, it is by no means a complete way to learn about the factors that impact stock pricing.

The most interesting part of the tutorial section is the Probability Lab explanation. With this new tool, it is possible to understand (or at least understand it better!) how the market is pricing in the future likelihood of a particular stock being at a particular price. It is definitely a tool the options enthusiasts will want to check out.

For those willing to put in the effort to learn it well, there is also a contest associated with this roll out which depends on a quiz that tests the understanding of the concepts covered in the tutorial. Those individuals (except for residents of Quebec to whom this contest is not open) who score perfect on the test can enter to win $20,000 in cash prizes.

From the Forums

This past week the forums were abuzz with activity from curious Canadian investors. While there were many interesting conversations, two mentioned below are important examples for DIY investors to pay attention to when dealing with discount brokerages.

What does the Fox say?

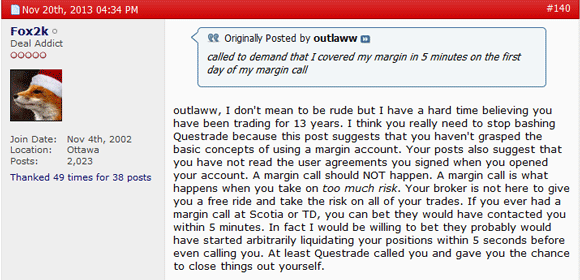

Apparently, the fox (rather the user ‘Fox2k’) says a whole lot when getting into a debate about a margin call and short selling at Questrade. As part of the highly charged ‘stay away from Questrade’ thread on RedFlagDeals, there was an interesting and heated exchange between members about an incident involving shares being recalled by Questrade while they were being shorted by the user ‘outlaww’.

This experience highlights the perils of margin trading and especially shorting stocks. For those thinking about shorting, recall that shorting a stock means borrowing it from the discount broker. Since they’ve lent it out, the broker can also ask for it back whenever they want to and they are also in a position to charge for the borrowing. The moral of the story – plan accordingly.

On a mission to explain commission

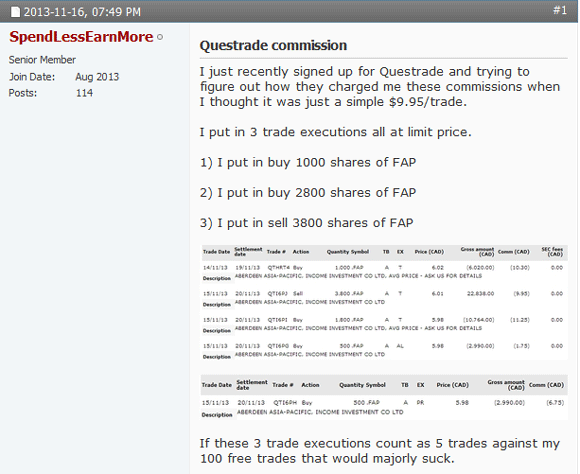

In this post on Canadian Money Forum, user ‘SpendLessEarnMore’ posted a series of recent trades made through Questrade in hopes of getting help from forum users to explain the commission charges associated with several trades. While Questrade customer service would certainly be in the best position to field that request, it is nonetheless interesting to note that when trading online, it is important to verify that trading commissions are accurately being assessed and to be able to understand in detail where charges are coming from.

Honorable Mentions

Here is a list of additional forum posts that might be of interest for DIY investors and those looking to stay on top of Canadian discount brokerages.

From Canadian Money Forum:

- Sources of investment information

- A follow up on where to get started with investment advice

- Bumps in the road for Interactive Brokers Canada

From Financial Webring:

From RedFlagDeals:

Alas that’s it for this week. Enjoy your weekend and here’s a thought to ponder as the Dow Jones Industrial Average pushes new all-time highs: ‘nothing lasts forever in the cold November rain’ – thanks to GnR for that ditty.