Advertisement

Table Of Contents

Key points

* Deals and promotions are important tools for online brokerages to continue to attract attention of online investors

* Established or larger players may not have to rely on them because they have already invested in advertising and there is some level of awareness

* Newer or smaller online brokerages will almost certainly need to get creative with new account promotions

Spring has sprung, and with it a renewed focus on growth and optimism for what’s ahead. Interestingly, online brokerages have also embraced a new season now that the RRSP season is over, and this one focuses on active investors.

In this abbreviated edition of the Roundup, we focus on deals and promotions offered by zero-commission online brokerages. Dive into the details of the newest promotions to emerge and what they signal for existing and potentially incoming online brokerages to consider. To wrap things up, we focus on investor commentary related to retirement accounts and slow-moving platforms.

New Deals in Town: Zero Commission Brokerages Continue Using Promotions to Drive Interest

The universe certainly has a sense of balance. When commission-free trading at Canadian online brokerages started to ramp up last year, deals and promotions at those same brokerages quietly faded away.

The break from deals and promotions at these brokerages, however, seems short-lived.

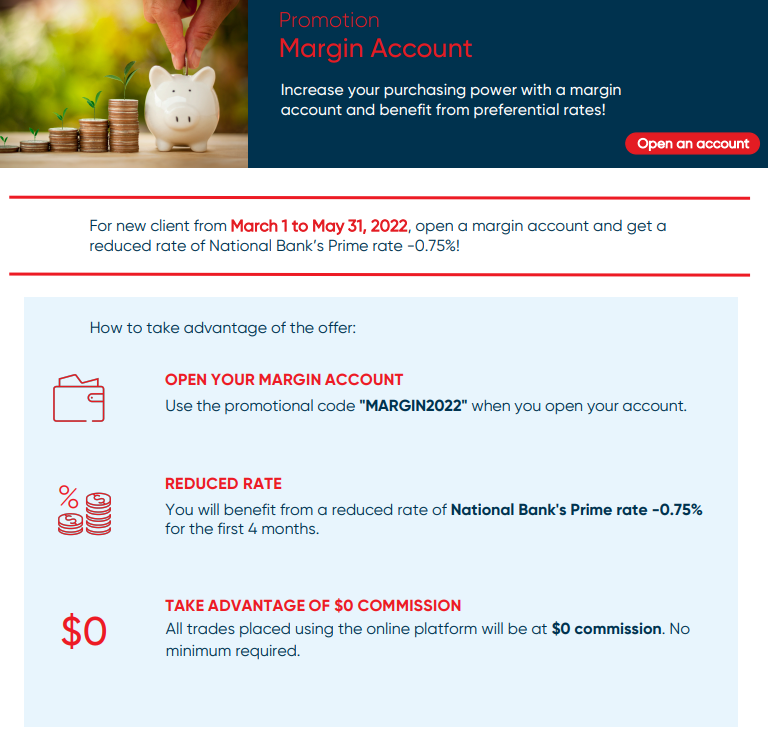

Earlier this month, National Bank Direct Brokerage (NBDB) quietly launched a new promotion offering discounted margin rates to new clients, and in doing so, signaled that despite their market-leading position on commission-free trading in Canada, they’re still prepared to get creative to attract new business.

Hot on the heels of the 2022 RRSP season, the timing of a launch of a new offer is also indicative of a new target audience: active traders. Trading on margin is not something that people thinking about retirement or RRSPs typically consider first, so the timing of this offer to go live after the RRSP season rush makes sense.

National Bank Direct Brokerage is not alone in that reasoning either. Wealthsimple Trade also launched their own limited-time offer aimed at the non-registered account crowd. Although their offer of a “free stock” cash back equivalent is ongoing, the boost to the amount for referrals to 3x the normal amount is clearly intended to generate some buzz.

Offering a promotion to attract new clients is a tricky proposition for a “zero-commission” brokerage.

After all, part of what should keep costs low is the controlled spending on acquiring new assets and customers. That said, when looking at the current group of “zero-commission” online brokerages in Canada, not only is the number of firms small (currently three) but two of the three firms are not well-known across Canada

Uncertainty Begets Volatility

When it comes to choosing an online brokerage, one of the biggest hurdles facing this specific group of zero-commission brokerages will be the uncertainty associated with them.

Unlike the entrenched Big Five bank-owned brokerages or names, such as Questrade and Qtrade that have been around for many years across Canada, the current group of zero-commission brokerages faces an uphill journey to become known and, more importantly, trusted.

A recent quote from Mike Foy, Senior Director of the Wealth Management Practice for North America at J.D. Power sums up the issue:

“Investors are increasingly bombarded by information from numerous sources including social media. We see the single biggest driver of online investor satisfaction with their broker is trust.”

Now that the surge in new retail investors coming to the market has somewhat abated, the challenge to Canadian online brokerages will be to create online investing tools and experiences that cater to this new group of investors and yet-to-be investors. And this is where promotions can offer a tactical advantage.

The latest promotion to launch from National Bank Direct Brokerage focuses on margin interest rates and serves as a good example where zero-commission brokerages can look to in order to attract attention while at the same time keeping costs contained. Although cash back or commission-free trades are welcomed, they’re not the only place that self-directed investors incur fees.

This past RRSP season demonstrated that online brokerages are spending aggressively on cash back promotions to attract new clients. For zero-commission online brokerages, pure cash back promotions are unlikely to be pursued because the costs may be prohibitively high. And as National Bank Direct Brokerage showed, there are now other costs that are up for negotiation.

Active is Attractive

National Bank Direct Brokerage’s focus on margin rates is a clear overture to active investors. The hope, it seems, is that in addition to the zero-commission trading commissions, there are other reasons to consider NBDB for a trial run or even as a separate or additional account.

Unless the direct competitor to NBDB, Desjardins Online Brokerage, follows suit with a similar offer, this latest deal will give National Bank Direct Brokerage an interesting combination of features worthy of a closer look by active self-directed investors.

With interest rates increasingly coming into focus for the next two years, getting a substantial break on higher interest rates for even a short time could be the catalyst that gets online investors talking about National Bank Direct Brokerage once again. And if there’s one sure fire way to achieve greater consideration in the online brokerage segment, it’s through the honest and unfiltered positive commentary of investors.

By lowering their commission prices to zero, National Bank Direct Brokerage has already ignited a conversation among online investors as to why they should pay attention to NBDB. This latest move seeks to steer the conversation once again in favour of this bank-owned brokerage. The key question, however, is who investors will stop talking about now that National Bank Direct Brokerage’s newest promotion is live.

From the Forums

Moving Day

There’s probably a reason that changing financial service providers is deliberately harder than it needs to be. This post from Reddit is fascinating because it highlights the challenges associated from moving accounts from one provider to another, but even more so, because it is a question about moving pension accounts – something that signals there are more than Millennials and Gen Z readers tuning into Reddit for information and guidance.

Not So Fast and Furious

“Time is money” takes on a whole other layer of meaning when it comes to trading online. In this Reddit thread, there is a chorus of complaints from active investors who find one online brokerage’s platform to be moving too slowly for their liking.

Into the Close

That’s a wrap on another Roundup. Although it was a bit of a light week (a March break?) heading into start of spring, “green shoots” are starting to appear in terms of investor education activities. We’re looking forward to the nicer weather and a chance to get out and about more, and we’re not alone. So, it will be interesting to see how the reopening starting to take place will impact the ability of online brokerages to capture and hold attention over the next few months. In the meantime, enjoy the signs of spring!