Advertisement

Table Of Contents

Key points

Elon Musk isn’t just a fan of shorts this summer. He’s also taken a pretty long view on bringing big ideas to fruition. As markets continue to press higher despite what appear to be doom-and-gloom messages about the real economy, it seems like the distant future is being priced in rather than the immediate one. […]

Elon Musk isn’t just a fan of shorts this summer. He’s also taken a pretty long view on bringing big ideas to fruition. As markets continue to press higher despite what appear to be doom-and-gloom messages about the real economy, it seems like the distant future is being priced in rather than the immediate one. Curiously, the thesis of looking past the current crisis is one that online brokerages appear to be doing, understanding (and hoping) that things will get resolved in due course.

In this edition of the Roundup, we take a look at a curious (but perhaps predictable) development at the largest online brokerage in the US and examine what their latest earnings report portends for the industry in the US and here in Canada. From there we’ll take a look over a different fence, at a popular Canadian robo-advisor that is clearly taking its cues from what’s working in wealth management (and online investing) in the US. As always, we’ve collected stories and reactions from DIY investors in the past week from the forums and on Twitter.

Online Brokerages See Weakening Earnings

There are some things that seem like a good idea, until they don’t.

This past week, the first in an upcoming wave of financial reports from US online brokerages was released, and the financial results were, um, not good.

The largest online broker in the US, Charles Schwab, reported their financial performance for the last quarter, and despite seeing record levels of new account sign-ups and record trading volumes, earnings came in lower than estimated.

This past quarter, Schwab added another 552,000 new accounts (excluding the 1.1 million accounts that came their way via the USAA acquisition), which was just over 9% less than the 609,000 new accounts opened the previous quarter. Nonetheless, a million new accounts in half a year is a staggering number when looked at across the past six months (although Robinhood managed to open 3 million new accounts in half that time). Also incredible was the daily trading volume, which clocked in at 1.62 million daily active trades, an increase over the 1.54 million daily active trades from the previous quarter.

With more clients and more trading, things should be rosy for an online brokerage, except for one small detail: Commissions for trading are now at zero.

What the new reality of operating in a zero-commission world translated into for the largest online broker in the US was that on the top line, Schwab missed on revenue estimates by a little ($40M USD), at $2.45 billion. However, when all was said and done, the bottom-line earnings of 48 cents per share was well short of the forecasted 53 cents per share. While this quarter may be disappointing on its own, when viewed against where Schwab was at last year, revenue is down 9% for the same three-month period, and net income is down a whopping 28%.

Even so, commissions don’t drive most of the earnings at Schwab anymore – instead, fees and interest revenue do. Nonetheless, it appears that structurally Schwab saw an opportunity to deepen its business in the online brokerage market by acquiring TD Ameritrade (and their assets as well as clients). Incidentally, as reported in their financial performance release, the deal to acquire Ameritrade has received regulatory clearance to proceed.

Despite the miss in terms of revenue and earnings, it appears there is a longer game at play, namely to massively scale up.

Schwab’s assets under management are now $4.11 trillion dollars (that’s trillion with a T) and continue to generate substantial revenue at healthy margins. For the time being, Schwab appears to be able to weather the storm of lower interest rates. However, it’s clear that zero-commission trading has challenged Schwab to find new revenue sources. The silver lining: their competition has to, too.

With the latest numbers coming out of the US, the fact that an online brokerage the scale and profile of Schwab is struggling to meet revenue and earnings forecasts suggests that Canadian discount brokerages will likely not be in any more of a rush to lower their commissions, least of all to zero.

A conversation this past week on BNN focused on the US online brokerage market and whether commission-free trading would or could gain traction here in Canada. The key takeaway in this segment is that Canadian online brokerages do not feel the pressure to match, in terms of pricing or offerings, what Schwab or Robinhood are currently doing in the US.

So, despite there being investor appetite and desire to see more commission-free trading here in Canada, there is no catalyst for online brokerages to do so at this time. That said, when investor appetite to wade into the market subsides – which the latest data on account openings suggests is taking place – online brokerages here in Canada are going to have to work especially hard to capture and hold the attention of folks who may have become accustomed to outsize returns in short amounts of time.

The next few weeks will be instructive to the direction for the rest of the year. We’ll be watching what happens with the largest players in the US discount brokerage space for clues on how Canadian discount brokerages will have to respond when/if another drop in commission pricing occurs.

Wealthsimple Makes Token Gesture to Launch into Crypto Trading

There’s no doubt that in the US online brokerage space, Robinhood has made a name for themselves not just for the low cost of trading but also for being agile around releasing new features and reimagining the user experience of an online brokerage account. From the time they launched in 2013 through to this year, Robinhood has grown its customer base from zero to over 12 million users and its valuation to $8.6 billion.

It is perhaps no accident, then, that Robinhood serves as an example of how to successfully connect with a younger audience of investors and why financial services providers in Canada (and the US), especially those in the wealth management/online brokerage space, would want to pay attention to the kinds of features being released by Robinhood.

In Canada, Wealthsimple appears to have followed in the footsteps of the US online brokerage when it comes to focusing on a younger audience and the user experience and attempting to democratize finance by making it “easier” and more accessible for most investors.

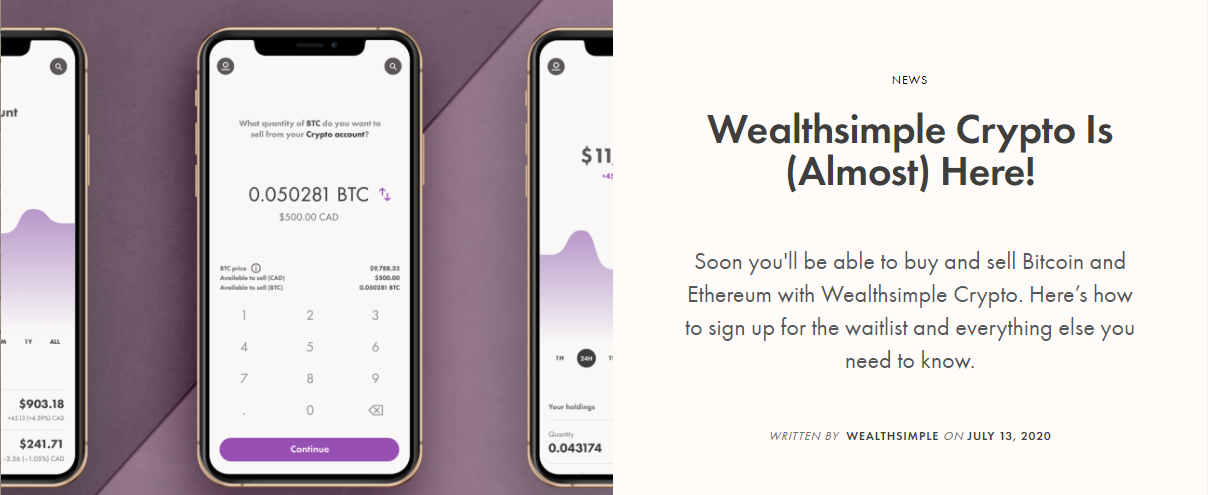

One clear parallel between Wealthsimple and Robinhood was the launch by Wealthsimple of their direct investing solution, Wealthsimple Trade, which charges no commission to buy or sell stocks. This past week, yet another parallel between these two firms emerged when Wealthsimple announced they would be exploring the launch of cryptocurrency trading.

Trading in cryptocurrencies was something that Robinhood launched in 2018 – right around the height of the crypto craze – and they have been rolling it out across the US since then. Two years into cryptocurrencies, much of the initial hype has died down, but it’s clearly a value driver for Robinhood clients curious or interested in trading it. Given the recent volatility in both Bitcoin and Ethereum, cryptocurrencies are finding their way back into the spotlight, so it is a good time for Wealthsimple to be launching their new trading platform.

In true Wealthsimple fashion, however, trading in cryptocurrency on their platform isn’t ready just yet, but that has not stopped them from garnering interest ahead of the release. As with their Wealthsimple Trade product, Wealthsimple has created a waitlist for interested parties to sign up for cryptocurrency trading when the trading feature becomes available.

In the highly commoditized environment of discount brokerages (and wealth management more broadly), what makes one brokerage stand out over another is going to become increasingly important. Pricing is still a place where this can happen – specifically commission pricing per trade – however, the other key value driver is in features, which is where Wealthsimple launching a cryptocurrency trading platform significantly differentiates them from their peers.

Perhaps another good piece of news for Wealthsimple is that they have close to two years to study what has happened with Robinhood’s cryptocurrency experience, to hopefully make this as smooth a deployment as possible.

Whether or not cryptocurrency picks up any time soon, it appears that because they will offer direct trading of cryptocurrenies, Wealthsimple will have ample room to run unchallenged by Canadian online brokerages, a rare situation in a highly competitive landscape.

The combination of a mobile-first mindset, a sound content strategy, low pricing, and a deliberate investment in aesthetic appeal means that Wealthsimple has raised the bar on most, if not all, online brokerages in Canada to step up or risk getting left behind.

Despite joining the crypto-trading party very late, Wealthsimple doesn’t have to be original to be considered innovative in the Canadian online brokerage space. They simply have to move faster than their peers at getting in-demand features up and running, which by this latest announcement it appears they’re managing to do.

Discount Brokerage Tweets of the Week

Discount Brokerage Tweets – Curated tweets by SparxTrading

From the Forums

The Graduate

A recent graduate turns to the forums for some clarification on the pros and cons of index funds and ETFs in this post. Fellow Redditors explain the advantages and disadvantages of each and offer insights into how timelines can impact one’s investment plans.

The Tortoise and the Hare

In this post, a curious Redditor ponders the age-old question of whether staying on a steady course is better than “splurging” on a potentially high-growth stock.

Discount Brokerage Tweets of the Week

Discount Brokerage Tweets – Curated tweets by SparxTrading

Into the Close

It’s been an interesting ride thus far, with markets continuing to press higher despite a worsening health crisis in the US. In the online brokerage space, this week will put a spotlight on earnings from other big online brokers and some business updates. Despite the summer weather outside, it seems like we’ll be glued to our screens as more news continues to break.